Calculate my mortgage repayments

Identify how much you may be able to borrow for a mortgage. In this calculator you can inclue investments annuities alimony government benefit payments in the other income sources.

Pin On Mortgage Calculator Tools

Make extra repayments to pay off your loan faster with no extra fees.

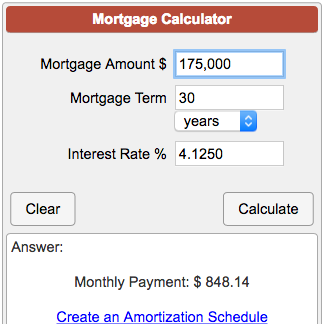

. To calculate your repayments you need to know what the principal is the amount youre borrowing what the interest rate is and loan. Homeowners can also calculate their mortgage repayments increase by using online tools such as Money Saving Experts repayment calculator. For example if you saved a 50000 deposit for a 200000 home your loan amount.

Calculate Your Mortgage Qualification Based on Income. At 60000 thats a 120000 to 150000 mortgage. How Much Mortgage Can I Afford if My Income Is 60000.

In the spreadsheet that I created once we put in the mortgage repayments we end up with a negative cash flow balance so it would seem that we cant afford a 420000 loan. Please ensure you obtain a personalised Mortgage Illustration before making a decision to proceed with a mortgage. A mortgage calculator can be a handy tool to help navigate finances prior to kickstarting your home-buying journey.

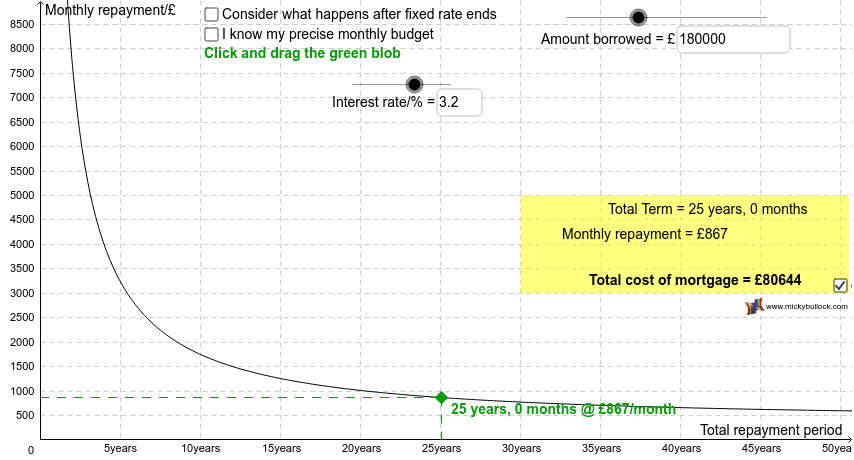

The usual rule of thumb is that you can afford a mortgage two to 25 times your income. This will be your monthly interest you will use to calculate mortgage payments. Provides graphed results along with monthly and yearly amortisation tables showing the capital and interest amounts paid each year.

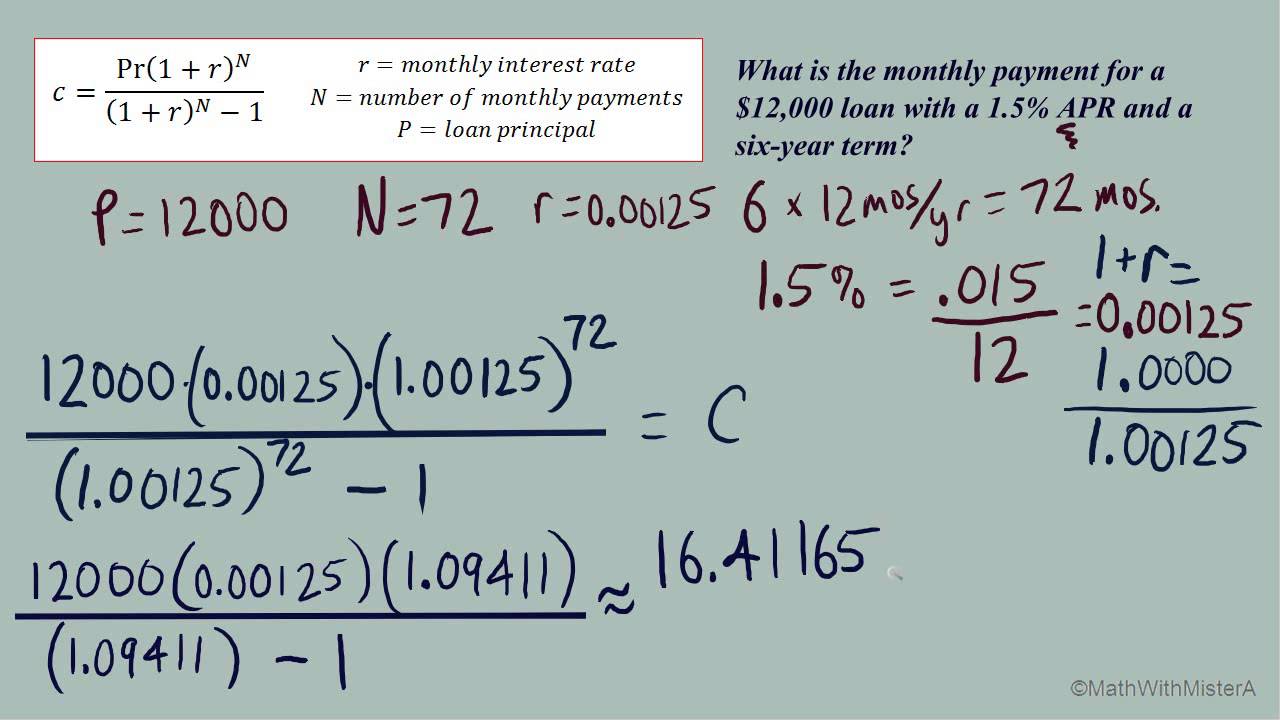

Enter the interest rate for your credit card balance in column B next to the Interest rate label. Must be less than 10000000. If you want to do the math by hand you can calculate your monthly mortgage payment not including taxes and insurance using the following equation.

What Mortgage Can I Afford Calculator. I came here to manually insert the full mortgage calculation into my budget spreadsheet but. Monthly repayments The calculator divides the mortgage amount and the total interest payable by the total number months in the mortgage term.

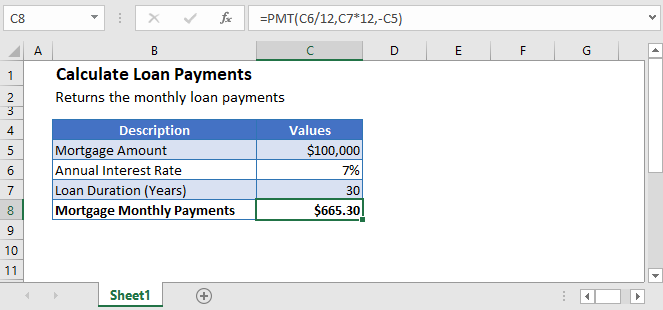

The rate argument is 5 divided by the 12 months in a year. If you already have an ING mortgage loan you can borrow part of the amount already repaid of your current mortgage loan under certain conditionsIn this case the applicable interest rate will be. The easiest way to calculate your mortgage repayments is by using a mortgage repayment calculator like the one above but you can also use equations or spreadsheets to work out what your repayments could be.

Your mortgage payment is defined as your principal and interest payment in this mortgage payoff calculatorWhen you pay extra on your principal balance you reduce the amount of your loan and save money on interest. We can help you calculate your monthly mortgage repayments. The loan amount P or principal which is the home-purchase price plus any other charges minus the down payment.

Be sure to select the correct frequency for your payments to calculate the correct annual income. An annuity is based on. With the cost of living crisis already bearing down on Brits inflation recently hit a 40-year high of 94 percent todays news is set to put even more strain on struggling families.

The number of years t you have to. Stamp Duty We believe that everyone should be able to own their home. How to calculate your mortgage repayments.

Fantastic explanations of how to calculate mortgage repayments yourself. Whether buying a new home refinancing an existing home loan or investing in property RAMS mortgage calculators can give you an estimate of what your repayments could be based on your home loan amount your loan type and the interest rate you think youll be paying. Calculate your mortgage repayments.

Imagine a 180000 home at 5 interest with a 30-year mortgage. Use our comprehensive online mortgage calculator which shows the monthly interest only and repayment amounts on a mortgage. Use our simple stamp duty calculator so that you can factor this into your budget.

To use our mortgage repayment calculator there are a few key pieces of information you will need to get the most accurate estimate of your mortgage. Using the function PMTrateNPERPV PMT5123012180000 the result is a monthly payment not including insurance and taxes of 96628. Calculate the additional repayment amount required to pay off your loan faster.

My mortgage provider automatically reduced my monthly payment as a result. The annual interest rate r on the loan but beware that this is not necessarily the APR because the mortgage is paid monthly not annually and that creates a slight difference between the APR and the interest rate. Put in your home loan details to get an instant estimate of your home loan repayments and interest charged.

The fixed monthly mortgage repayment calculation is based on the annuity formula Annuity Formula An annuity is the series of periodic payments to be received at the beginning of each period or the end of it. The formula for mortgage basically revolves around the fixed monthly payment and the amount of outstanding loan. Keep in mind that you may pay for other costs in your monthly payment such as homeowners insurance property taxes and private mortgage insurance PMI.

I had to ask it to reduce the term instead If your mortgage provider alters your repayments to keep the term the same although it will boost your monthly disposable income you wont save on your interest payments and the lender will earn more. Calculate the cost of mortgage repayments. 2019 The Mortgage Centres are authorised and regulated by the Financial Conduct Authority for protection residential mortgages and general insurance business.

When you take out a home loan you are required to make regular minimum interest repayments as well as any fees for the amount you have borrowed. M P i1 in 1 in 1 P. If you do not yet have a mortgage loan and want to borrow more than 25000 for your renovations it may be worth financing your project with the help of a mortgage loan.

These calculations can also be done in a different order 6100 006 00312 0005. The figures provided by this calculator are for information purposes only. A mortgage calculator helps to.

Dont have a mortgage and want to find out what your repayments could be and how long it could take to pay it off. What is Mortgage Formula. Property price Must be more than 0.

Figure out monthly mortgage payments. Choose the frequency of your repayments weekly fortnightly or monthly If youd like to switch between principal and interest and interest only repayments or vice versa on your variable loan contact one of our home loan specialists who will talk to you about your options. Because the interest rate listed on your credit card statement is an annual rate but this calculation requires the monthly interest amount calculate the interest within the cell by dividing the interest rate by the number of months in a year 12.

Adding the mortgage repayment into you Cash Flow Budget will automatically change the totals for Total Expenses and Net Cash Flow. Land and Buildings Transfer Tax We can help you calculate your monthly mortgage repayments.

Mortgage Calculator With Extra Payments And Lump Sum Excel Template

Mortgage Calculator Youtube

Download Microsoft Excel Mortgage Calculator Spreadsheet Xlsx Excel Loan Amortization Schedule Template With Extra Payments

Mortgage Repayment Calculator

Mortgage Interest Payment Calculator On Sale 60 Off Www Ingeniovirtual Com

How To Calculate A Mortgage Payment Youtube

Online Mortgage Calculator Wolfram Alpha

Excel Formula Estimate Mortgage Payment Exceljet

How To Calculate Monthly Mortgage Payment In Excel

Loan Constant Tables Double Entry Bookkeeping Mortgage Loans Mortgage Calculator Loan

Calculate Loan Payments In Excel Google Sheets Automate Excel

Mortgage Leaflet Design Mortgage Info Mortgage Reverse Mortgage

Graphical Mortgage Repayment Calculator Geogebra

Downloadable Free Mortgage Calculator Tool

Free Interest Only Loan Calculator For Excel

Extra Payment Mortgage Calculator For Excel

Downloadable Free Mortgage Calculator Tool